Mumbai, May 22: The Bombay High Court recently cancels a non-bailable warrant issued against Bollywood actor Arjun Rampal in a 2019 tax evasion case.

Vacation judge Justice Advait M Sethna said that the warrant was issued without proper application of judicial mind and in a matter involving a bailable offence.

“The order dated 9 April 2025 passed by the Additional Chief Metropolitan Magistrate, 38th Court at Ballard Pier, Mumbai is quashed and set aside,” the High Court said in its order of May 16.

The petition challenged two key orders – the initial issuance of process in 2019 and the more recent order dated April 9, 2025 passed by the Additional Chief Metropolitan Magistrate at 38th Court, Ballard Pier, Mumbai, who issued a non-bailable warrant against Rampal in the 2019 case.

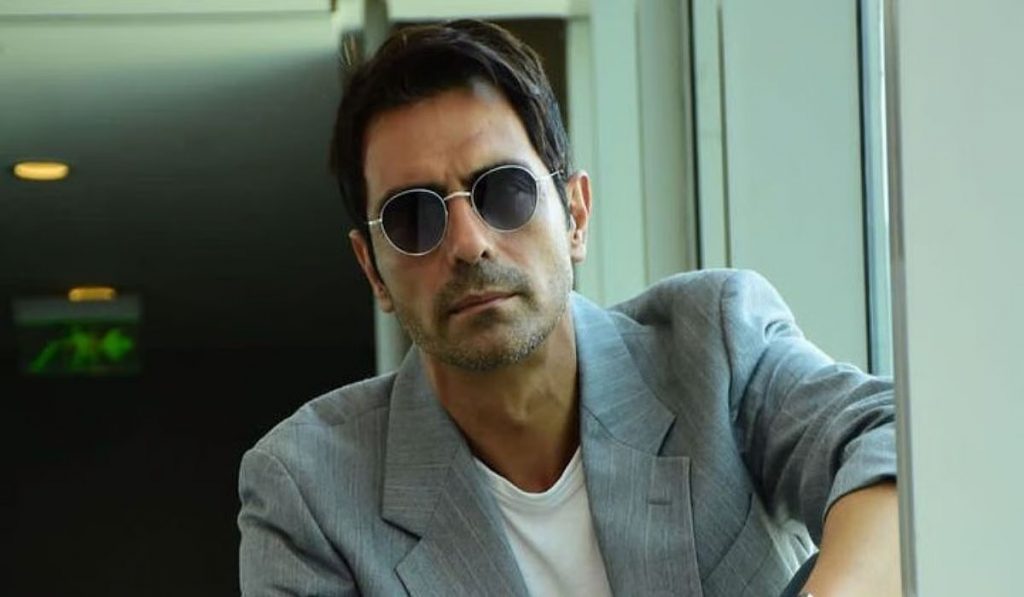

Rampal, a prominent actor known for his roles in movies like Don (2006), Om Shanti Om (2007) and Raajneeti (2010), is facing prosecution under Section 276C(2) of the Income Tax Act, 1961.

The provision deals with the wilful attempt to evade payment of tax and prescribes a maximum punishment of three years.

The High Court observed that the Magistrate had issued the warrant despite being informed that Rampal’s counsel had submitted a vakalatnama along with an application for exemption from personal appearance on the day the order was passed.

Justice Sethna noted that the order lacked reasons and demonstrated a mechanical approach, and it was “cryptic” and “contrary to law.”

“The learned Magistrate however not taking into consideration such position, has mechanically passed the order issuing the non-bailable warrant against the petitioner in a bailable offence. On a perusal of the said order, it is clear that no reasons are recorded. In my view, it is a cryptic order which lacks application of mind. This would cause prejudice to the petitioner in the given the facts and circumstances as he would face an order of non bailable warrant in a case of bailable offence,” the Court said.

While the Income Tax Department initially sought time to obtain instructions, it did not oppose the limited relief sought.

Accordingly, the High Court quashed the order dated April 9 and clarified that proceedings on merits before the Magistrate would continue as per law.

It also scheduled further hearing on June 16 before the regular bench, where Rampal’s challenge to the original issuance of process on December 5, 2019, will be considered.