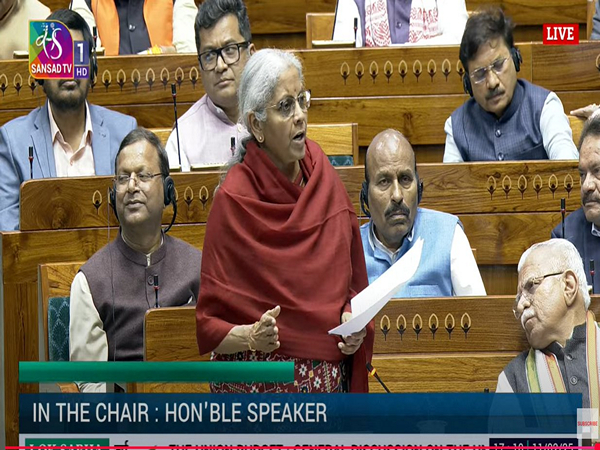

New Delhi: The Finance Minister Nirmala Sitharaman on Tuesday said that the government is using almost the entire borrowed resources for financing effective capital expenditure.

The minister, who was replying to a marathon debate in Lok Sabha on 2025-26 budget, said that effective capital expenditure is projected at 15.48 lakh crore as against 13.18 lakh crore in the revised estimates of 2024-25.

She said the effective capital expenditure for 2025-26 is 4.3 percent of GDP as compared to the fiscal deficit target of 4.4 per cent.

Capital expenditure, or capex, is used to set up long-term physical or fixed assets.

Effective capital expenditure includes core capital outlays and the grants in aid to states for creation of capital assets. Though the grants in aid for creation of capital assets are accounted in the Budget as revenue expenditure, they go for creating capital assets in the states, she said.

The difference between the two is minimal, she said, explaining that it indicates that the government is using almost the entire borrowed resources for financing effective capital expenditure.

“The borrowings are not going for revenue expenditure or committed expenditure or any of those kinds. It’s only for creating capital assets. So in effect, the government intends to use about 99 percent of borrowed resources to finance effective capital expenditure in the upcoming 2025-26 financial year,” she said.

The difference between total revenue and total expenditure of the government is termed as the fiscal deficit. It is an indication of the total borrowings that may be needed by the government.

The capital expenditure outlay of Rs 15.48 lakh crore for fiscal year 2025-26 includes Rs 11.21 lakh crore in direct central government spending and Rs 4.27 lakh crore in grants to states for capital projects.

Answering queries on rupee depreciation, she said the depreciation is less compared to some other currencies.

She noted various domestic and global factors influence the exchange rate of Indian rupee. The factors include movement of dollar index, trend in capital flows, level of interest rates, movement in crude prices and current account deficit.