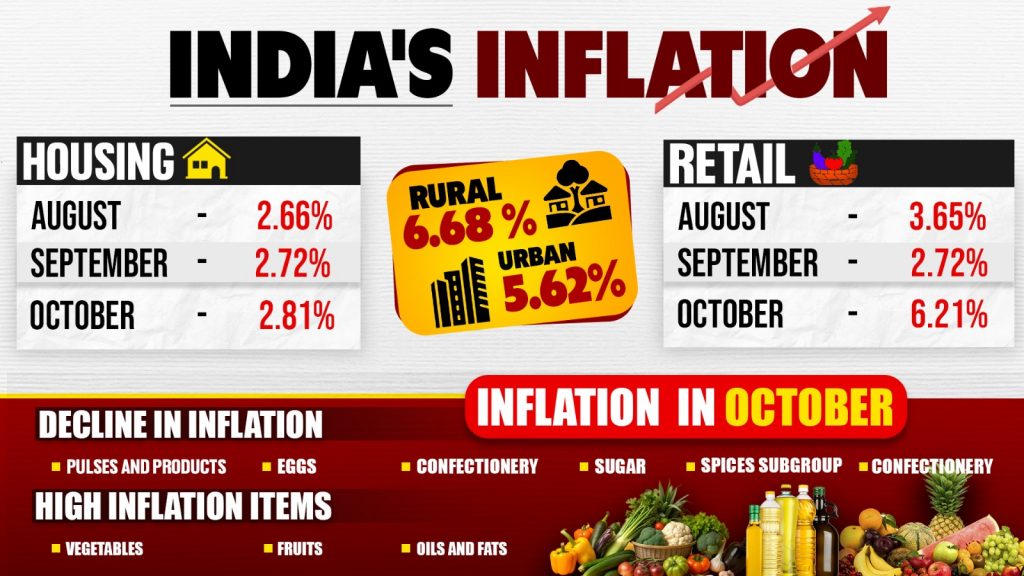

New Delhi : India’s retail inflation was at 6.21 per cent in October, breaching the Reserve Bank of India’s 6 per cent upper tolerance level.

According to data released by the Ministry of Statistics and Programme Implementation on Tuesday, food inflation was at 10.87 per cent. Notably, vegetable Inflation was at 42.18 per cent.

Corresponding inflation rates for rural and urban were at 6.68 per cent and 5.62 per cent, respectively.

Year-on-year Housing inflation rate for October 2024 is 2.81 per cent. The corresponding inflation rate for September 2024 was 2.72 per cent. The housing index is compiled for the urban sector only.

During the month of October, a significant decline in inflation has been observed in the pulses and products, eggs, sugar and confectionery and spices subgroup.

High food inflation in October is mainly due to an increase in the inflation of vegetables, fruits, and oils and fats.

August retail inflation, at 3.65 per cent, was the second lowest in the last five years, and since then it has been rising.

Food prices continue to remain a pain point for the policymakers in India, who wish to bring retail inflation to 4 per cent on a sustainable basis. But today’s inflation data once again reaffirms that the inflation has not aligned with the intended target.

Inflation has been a concern for many countries, including advanced economies, but India has largely managed to steer its inflation trajectory quite well. The ease in month-on-month retail inflation, barring June, came on the heels of RBI having maintained the status quo in the repo rate for the ninth straight occasion.

Going forward, all eyes will be on the Kharif harvest season and progress in rabi sowing will also be keenly watched.

The RBI has kept the repo rate elevated at 6.5 per cent to keep inflation contained. The repo rate is the rate of interest at which the RBI lends to other banks.