New Delhi: The Lok Sabha on Tuesday passed the Finance bill 2025 after the House adopted the amendments moved by the Finance Minister. The debate on the bill began on Monday.

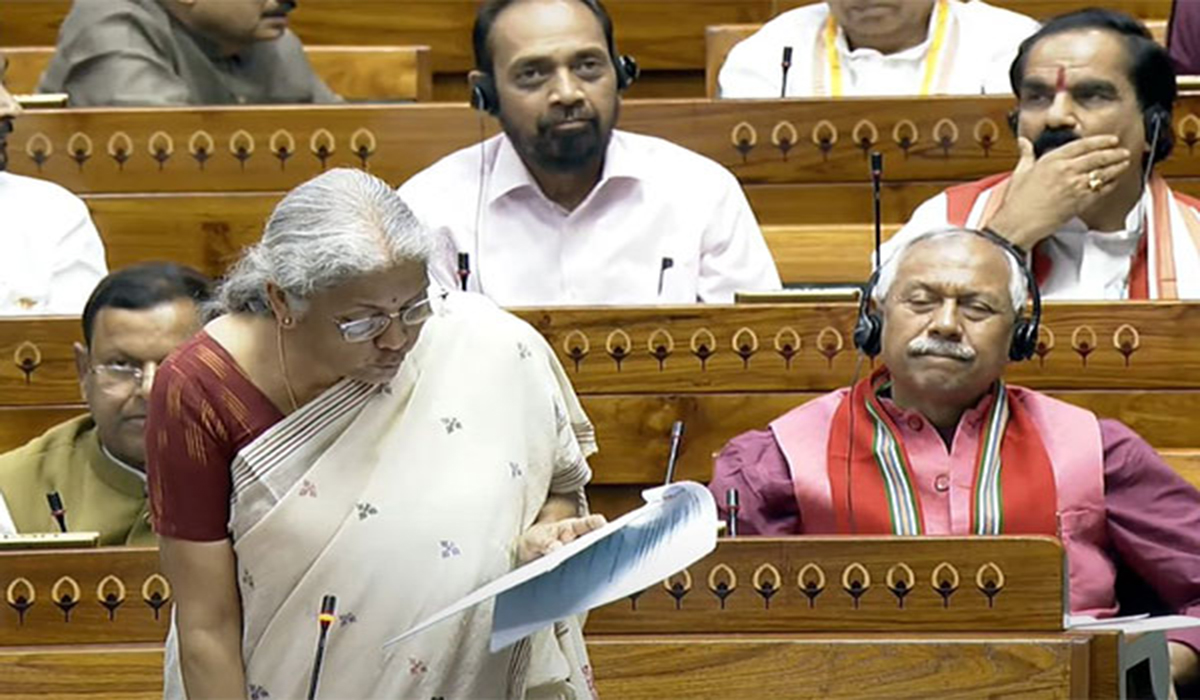

Finance Minister Nirmal Sitharaman after Lok Sabha passing of the Bill, stated the government has sought to do several things in the legislation as per the aspirations and expectations of people and the goal of making India a developed country by 2047.

“This Finance Bill, we have attempted to do several things, which are as per the aspiration and the expectation of the people of India and also the goal that the Prime Minister has given us towards the Viksit Bharat by 2047,” Sitharaman said.

She said the bill aims to provide tax certainty.

“It rationalises a lot of provisions which are towards ease of doing business and also provides unprecedented tax relief,” she said.

The minister talked about the tax relief provided to people in the union budget and the government’s nudge to increase tax mobilisation from those who have foreign assets.

She gave reply to the queries raised by members including on the GST.

Participating in the discussion, opposition members accused the government of “patchwork solutions” and “flawed GST”.

The BJP members lauded the economic performance of the government saying that country’s GDP has more than doubled in the last 10 years.

Congress MP Shashi Tharoor said that the government’s economic management faces deep-rooted structural challenges.

He took potshots at Finance Minister Nirmala Sitharaman. “Looking at this year’s Finance Bill… I think she has slightly changed her tune. She is now telling taxpayers, ‘I couldn’t repair the roof, so I bought you an umbrella.’ This Finance Bill is a classic case of patchwork solutions at a time when the nation needs clarity, conviction, and decisive leadership. The government’s economic management find itself in grasp of deep rooted structural challenges. We have seen growth targets being scaled down, double-digit growth is apparently unattainable and the ambitions of maintaining a respectable growth rate is fading away,” he said.

“The portion of our population engaged in agriculture is higher than ever while manufacturing has shrunk around 15 per cent of the GDP. Even those who are earning five or six times per-capita income are now struggling to maintain their standard of living. So ‘Viksit Bharat’ by 2047 is a laudable objective for a quarter century from now but how does this Finance Bill begin to get us there,” Tharoor asked.

He said it has taken government years to finally realize that just two per cent of Indians, the hardworking taxpayers, have been carrying this country on their back.

The government had presented the union budget on February 1. The passing of the Finance Bill marks the end of the budget process in Parliament.