New Delhi: The government of India has given a big relief to taxpayers. The relief is in regard to the TDS/TCS deduction. An exemption has been given to tax payers with deactive PAN (Permanent Account Number). A circular regarding this has been issued by the Revenue Department of the Finance Ministry on Tuesday. As per the rule, double TDS is deducted if the PAN is not linked with the Aadhar card. Now as per the new rules, exemption has been given to those with inactive PAN. Now there will be no deduction if the PAN of taxpayer is not active.

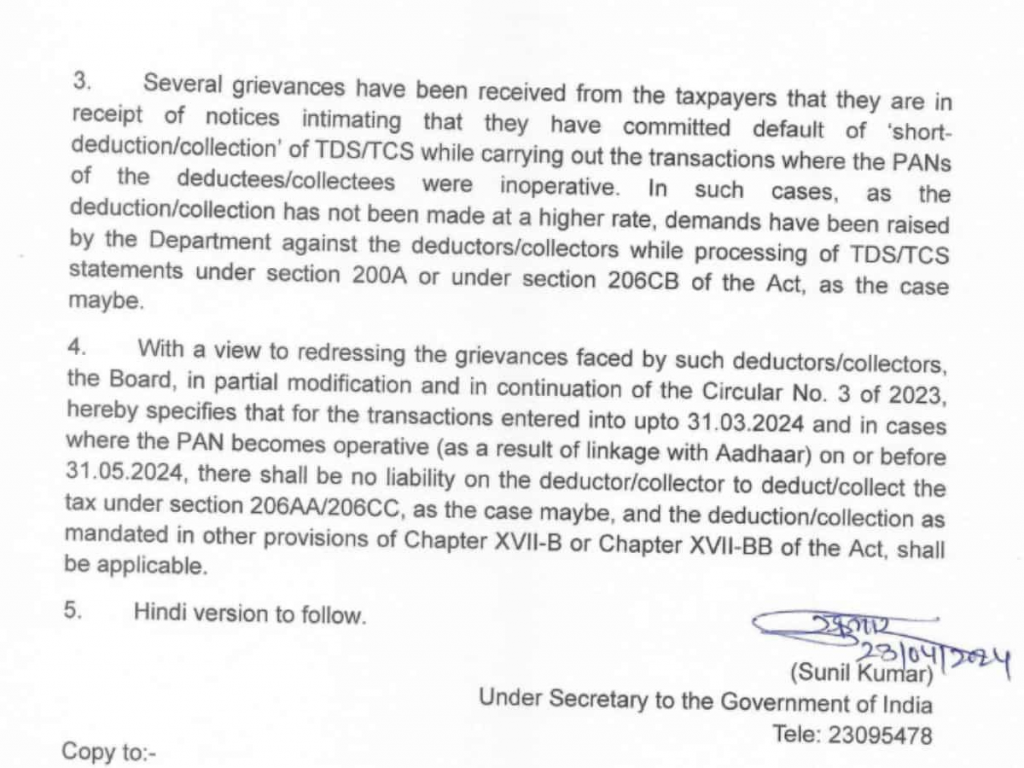

The circular read, “Several grievances have been received from the taxpayers that they are in receipt of notices intimating that they have committed default of ‘short- deduction/collection’ of TDS/TCS while carrying out the transactions where the PANS of the deductees/collectees were inoperative. In such cases, as the deduction/collection has not been made at a higher rate, demands have been raised by the Department against the deductors/collectors while processing of TDS/TCS statements under section 200A or under section 206CB of the Act, as the case maybe.”

It further read, “With a view to redressing the grievances faced by such deductors/collectors, the Board, in partial modification and in continuation of the Circular No. 3 of 2023, hereby specifies that for the transactions entered into upto 31.03.2024 and in cases where the PAN becomes operative (as a result of linkage with Aadhaar) on or before 31.05.2024, there shall be no liability on the deductor/collector to deduct/collect the tax under section 206AA/206CC, as the case maybe, and the deduction/collection as mandated in other provisions of Chapter XVII-B or Chapter XVII-BB of the Act, shall be applicable.”