Reserve Bank of India (RBI) has not changed the interest rates for the sixth consecutive time. RBI has kept the interest rates unchanged at 6.5%. That means the loan will not be expensive and your EMI will also not increase. RBI last raised rates by 0.25% to 6.5% in February 2023.

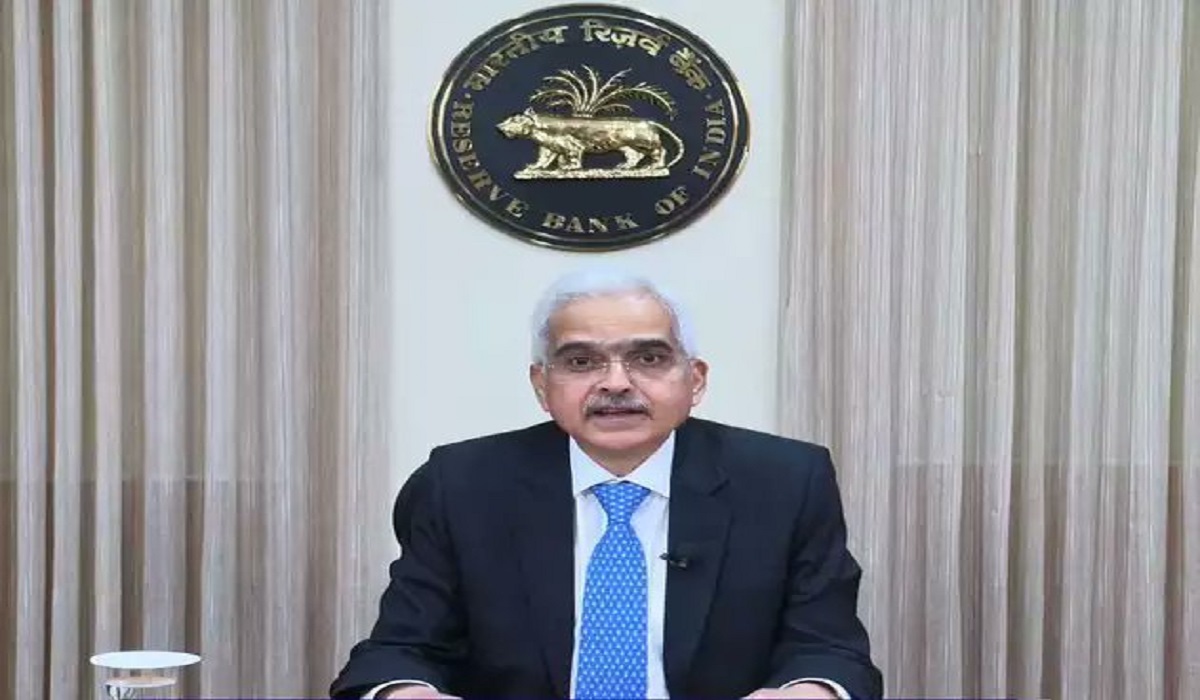

RBI Governor Shaktikanta Das gave information about the decisions taken in the Monetary Policy Committee (MPC) meeting going on from February 6 today i.e. on Thursday. This meeting takes place every two months. RBI had not increased interest rates in its earlier December meeting.

There are six members in the MPC of RBI. It has both external and RBI officials. Along with Governor Das, RBI officials Rajeev Ranjan, serves as executive director, and Michael Debabrata Patra, deputy governor. Shashank Bhide, Ashima Goyal and Jayant R Verma are external members.

Repo rate is a powerful tool to fight inflation

RBI has a powerful tool to fight inflation in the form of repo rate. When inflation is very high, RBI tries to reduce money flow in the economy by increasing the repo rate. If the repo rate is high then the loan received by banks from RBI will be expensive.

In return, banks make loans costlier for their customers. This reduces money flow in the economy. If money flow decreases, demand decreases and inflation decreases.

Similarly, when the economy goes through a bad phase, there is a need to increase money flow for recovery. In such a situation, RBI reduces the repo rate. Due to this, the loan from RBI becomes cheaper for the banks and the customers also get the loan at a cheaper rate.

Let us understand this with an example. When economic activities came to a standstill during the Corona period, demand decreased. In such a situation, RBI had increased the money flow in the economy by reducing interest rates.