Mumbai: Indian Equity markets have been on a positive trajectory recently, with the Nifty up early 2% and retail investors optimistic about the start of new bull run. However, some experts argue that the next decade might differ from previous boom periods. While past few years saw impressive earnings growth, the market faces a potential slowdown, leading to more moderate returns ahead. The current correction reflects the syclical nature of markets, suggesting a more balanced approach to investing.

Over the past week, Indian equity markets are up almost 2% with the Nifty trending at 23,589. Retail investors are happy and renowned experts are going out and claiming it to be the ‘start of a new bull run’. However, there are a few who feel the next 10 years will be different from all the past boom periods that India has witnessed so far.

In the past two decades, the #Nifty50 has returned 12% annually. Smart investors believe the country can do far better than this number in the coming decade. But markets are cyclical in nature. There is a high chance that we might actually get lower annual returns compared to the past.

Markets have had a sizeable correction from the highs seen in last September peak. It has been a painful grind in the last six months for investors. For nearly 80% of them, the correction is somewhat a new phenomenon, and totally unexpected. These new investors had come in for linear returns and were trained to ‘buy the dips’. They had the best for the past 5 years, up until now.

What was driving the rise?

When you buy a stock, you buy a share in its earnings. The earnings per share (EPS) decides the price it should trade at (at least some of it). The other element comes from the market sentiment, which relies on future prospects for the current earnings. What India witnessed last five years was the boost on both these elements. Let us look at earnings first.

Nifty EPS was around INR430 by end of 2019. During the next 4 years, by the end of 2023, it rose to INR950. That is an astounding CAGR of 22%. If you looked at the historical 10-year trend till 2019, the range was much below 10%. This earnings surprise increased valuations. Common sense would tell you that Nifty should double too. And it did. From 12,500 to neat 25,000 rise was largely justified. At least in theory!

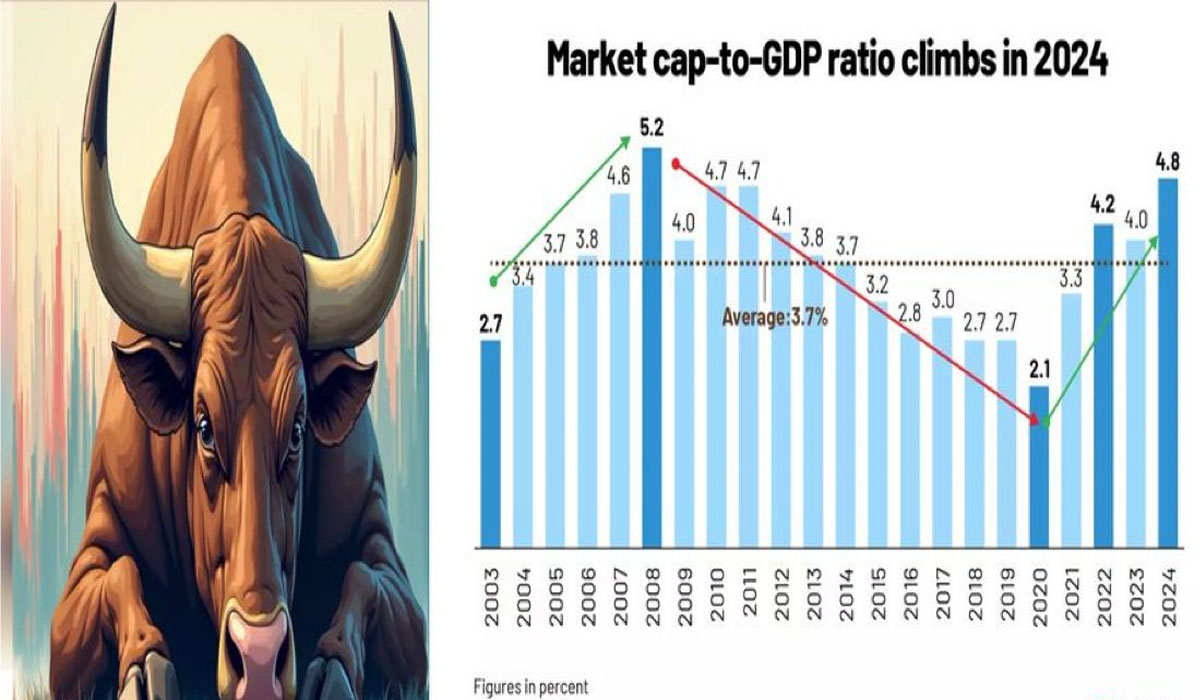

If we broaden this story and look at the entire listed corporate space, corporate profits jumped from around INR4 lakh crore (USD45 billion) to INR16 lakh crore (USD170 billion) during the same duration. This was nearly 4.8% of GDP. No wonder, we saw a bump in valuations across Nifty 500 Index.

Markets assumed the similar rate of growth and priced the stocks accordingly. Not to forget, the flow of domestic money to mutual funds provided more gas to stocks outside of Nifty 50. The mid- and small-cap stock prices grew significantly higher, at almost 30% CAGR for 4 years. This was far in excess of the EPS growth in these stocks.

This super growth phenomenon however is always shortlived. We’ve had these phases before. There is nothing new about this.

Why did the markets fall and why now?

The surge in earnings post-2020 was driven by factors like clean bank balance sheets, demand for IT services, consumer spending, and increased government capital expenditure. However, that surge is behind us now. As a result, earnings growth is slowing, and estimates for Nifty 500 companies show a modest 7% topline growth in 2024, just enough to keep up with inflation.

So, why did the earnings spike post 2020?

A confluence of factors resulted in earnings growth post 2020. Firstly, banks’ balance sheets were already clean after years of NPA write-offs post 2014. After pandemic, we had a sudden demand surge — IT services got huge demand boost from US, there was discretionary revenge spending by consumers & finally the govt capital expenditure increase 4 times to INR11 lakh crore (USD125 billion). All of this happened within 3 years. Indian retail credit penetration increased from 20% of GDP to 43% of GDP. So much of the consumer spending was done with credit binge too.

All that spending is behind us now. So, unless you have a reason to believe that the economy has drastically improved after 2020, it is safe to assume that the earnings growth will also correct. And this is already underway since 2024. Estimates for Nifty 500 companies is at 7% topline growth. This is just about keeping up with inflation.

For context, look at the topline growth for #Nifty500 companies below. It tells a similar story since 2010 where sales growth slowed after 2009. And then the huge spike after 2020.

While sales growth slowed by 2022, margins expanded, which concealed the slowing topline. That provided some cushion to the EPS story for a year. However, EPS can’t grow continuously if topline stagnates.

When will markets capture previous peaks?

The market’s future depends on corporate earnings and India’s economic growth. After 2009, corporate earnings grew slowly, and Nifty returns were modest—around 8% annually. While this cycle may be different, history shows that after periods of exuberant growth, markets often experience moderation.

The current correction is not a short-term blip. It is driven by a slowdown that has been building for 18 months, and recovery could take time. Consumer sentiment and government spending will play key roles in the recovery.

What to expect

The comparisons that forever bullish gurus quote from US markets don’t apply to any other country. If you pick a historical point from US markets, you can prove almost anything. India story works differently too, unless the economy undergoes a drastic transformation, something like China had for last 30 years. While that is possible, it is also extremely rare.

In the next five years, the market may experience moderate growth as it absorbs high valuations. The returns from Nifty 500 are likely to be around 10% annually for the decade between 2021 and 2031. Investors should focus on a balanced portfolio and understand that linear growth was never a realistic expectation.

A healthy dose of realism is always good in investing. Else, you end up buying expensive con stories from faceless sellers who get rich with your money. Some of you may have realised that by now.

The India bull ran fast as it could. But it needs some well-deserved rest. Let it rest for now.