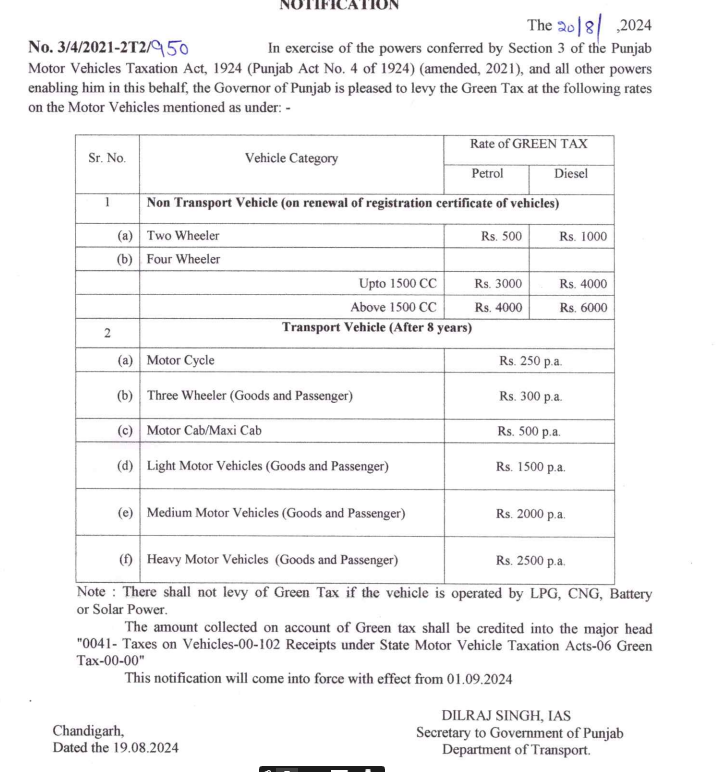

Registration of vehicles in Punjab has now become expensive, as green tax has been implemented in the state. Notification has been issued in this regard. In such a situation, now non-transport vehicles (on renewal of vehicle registration certificate) will have to pay green tax. It has been kept separately on diesel and petrol vehicles. But vehicles running on LPG, CNG, battery or solar power have been kept out of this category. One and a half to two percent tax will be levied on making RC of vehicles.

Now for registration of 15-year-old non-transport vehicles, petrol two-wheeler vehicle owners will have to pay 500, and diesel drivers will have to pay one thousand green tax. Similarly, for four-wheeler vehicles below 1500 cc, petrol will have to pay 3000 and diesel vehicles will have to pay four thousand rupees. Similarly, a fee of 4 thousand has been fixed on 1500 cc petrol two-wheeler and 6 thousand rupees on diesel vehicle.

Similarly, new taxes have been fixed for transport vehicles. According to this, after 8 years of vehicle registration, they will have to pay it every year. For such commercial motorcycles, the tax has been fixed at Rs 200, three-wheeler (goods and passenger) at Rs 300, motor cab/maxi cab at Rs 500, light motor (goods and passenger) at Rs 1500, medium motor vehicle (goods and passenger) at Rs 2000 and heavy vehicle (goods and passenger) at Rs 2500 per annum.

An important meeting of the Punjab Cabinet was held in Chandigarh on August 14. In this meeting, approval was given to impose green tax on old vehicles. This will generate an income of Rs 87.03 crore. This money will be spent on saving the environment and other work. Because the government’s focus is to increase greenery in Punjab. On the other hand, the government has now excluded CNG and electric vehicles from this category.